Best Place to Work

Firstmark has been named a Best Place to Work for five years in a row!

Having the right credit card just makes life easier. We offer two Firstmark ONE® VISA® Credit Cards with great rates and rewards to help you live your best life. And with Digital Wallet, you can shop with ease and convenience.

With our card rewards program, you can earn points for every dollar you spend with your Firstmark ONE® VISA® Platinum Rewards Credit Card!

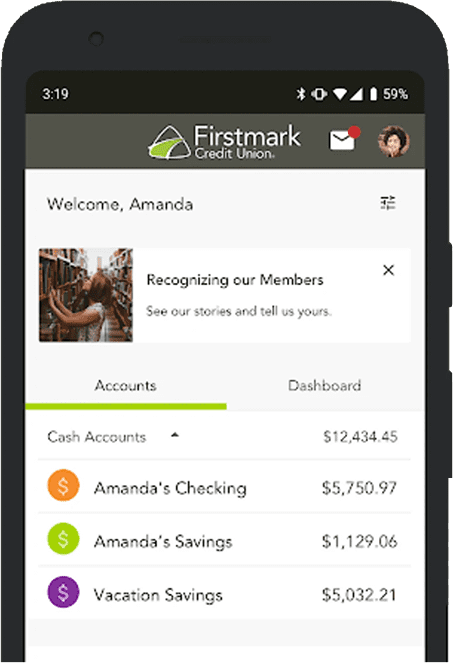

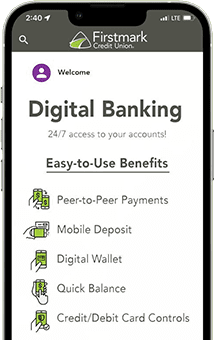

Download the Firstmark Mobile App to manage your credit cards with just a few clicks!

Log in and select your Firstmark credit card to:

Banking made easy from anywhere you are!

Protecting your personal and financial information is our top priority. Our courtesy credit card alerts help keep your personal information safe and may protect you from fraud.

Enroll your card to instantly begin receiving alerts notifying you when transactions are made to your account.

For members who elect to receive alerts via text message, standard text message and data rates apply. Please check with your mobile carrier to ensure that you own an SMS capable mobile handset that is registered on a carrier network and elected for a data plan that includes use of the mobile handset’s SMS capabilities.

Log in to Digital Banking to sign up for card alerts.

| Which Card Is Right For Me? | Firstmark ONE® Visa® Platinum | Firstmark ONE® Visa® Platinum Rewards |

|---|---|---|

| What is most important to you in selecting a card? | Lowest Rate | Low Rate With Rewards or Cash Back Option |

| How would you describe your credit card usage? | Occasional I only use it when cash is not available |

Moderate I use it when it’s convenient and on larger purchases |

| Do you carry a balance on your card? | Often I want to minimize the interest that I am charged |

Sometimes During certain times of the year |

| On average, how much do you charge on your credit card per month? | $50 – $500 | $250 – $1,000 |

Annual Percentage Rate (APR) is accurate as of 02/27/2026. Firstmark ONE® VISA® Platinum: Rates may vary depending on your creditworthiness, and your specific APR will range between 12.25% and 18%. Penalty APR: 18.00%. Firstmark ONE® VISA® Platinum Rewards: Rates may vary depending on your creditworthiness, and your specific APR will range between 15.25% and 18%. Penalty APR: 18.00%. Minimum 680 FICO score required to qualify for an unsecured credit card and subject to final credit approval. Other restrictions, terms, and conditions apply. Credit union membership is required and is subject to approval. Firstmark uses Equifax/FICO Auto V8 Facta which may render a different credit score from other credit reporting agencies. FICO is a registered trademark of the Fair Isaac Corporation in the United States and other countries. Qualifying criteria may be subject to change.

Firstmark has been named a Best Place to Work for five years in a row!