MENUMENU

- Join Us

- Our Story

-

-

-

Our story began over 90 years ago at Fox Tech High School, where ten teachers signed a charter to form San Antonio Teachers Credit Union.

-

-

- Loans

- Accounts

- Firstmark Foundation

Buying a home is a big deal, and we know the home buying process is different for everyone. Whether you are buying new or refinancing, our mortgage loan experts will be with you each step of the way to help find the right mortgage for you.

Visit our Home Buyers Checklist page for guidance on the home buying process.

At Firstmark we understand that a home is more than four walls and a roof. Now that you found that perfect house, let us help you make it your dream home with financing options just for you. Buying a new home can be complicated. Let our team of dedicated professionals help you navigate the challenges so you get the most for your dollar.

We have simplified the application process to streamline buying a home. You can upload required documents and connect with your financial institution without the tedious task of collecting, faxing and printing files. You can rest assured knowing that your documents are safe and secure. It’s so simple that you can complete a mortgage application with your mobile device or from your laptop.

Firstmark Credit Union

NMLS#643550

855-202-7538

Our 5/5 Adjustable Rate Mortgage (ARM) loan might be right for you if you

With low rates and flexible terms, home ownership is within your reach.

To get started, schedule a phone appointment with our Mortgage Loan Officer, to discuss your specific goals. We can explain the process, answer your questions, and help you come up with a plan.

You should get pre-qualified for a mortgage loan prior to setting up any realtor meetings.

It is recommended that members save money, keep debts low and avoid new credit inquiries if possible.

To qualify for a mortgage loan, you must have enough household income to cover all your bills. Be prepared to provide paystubs, W-2’s, bank statements and possibly tax returns.

Yes, student loan payments are included when calculating your debt to income ratio. In some cases, a payment amount will be created even if the current payment is $0.

The conventional loan limit is currently $776,550.

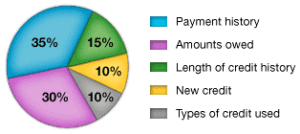

The two biggest factors that affect credit scores are payment history and amounts owed. You can begin to repair your credit history if you focus on keeping up with these two factors by

Use this calculator to compute the payment amount1 by adjusting the amount, rate and terms.

Services provided via partnership with TruHome Solutions, LLC (NMLS #284608) and are subject to credit and property approval. Other restrictions and conditions may apply. Programs and guidelines are subject to change without notice. Rates are subject to change daily. TruHome Solutions, LLC located at 6330 Sprint Parkway, Suite 200, Overland Park, KS 66211. See: www.nmlsconsumeraccess.org.

The information provided by these calculators is for illustrative purposes only. The default figures shown are hypothetical and may not be applicable to your individual situation. Be sure to consult a financial professional prior to relying on the results. The calculated results are intended for illustrative purposes only and accuracy is not guaranteed.

Log into Online Banking

Need to Enroll in Online Banking

To make this process as quick as possible, please have the following ready:

Not signed up for online banking?

No problem, click here.

Log into Online Banking

Need to Enroll in Online Banking

To make this process as quick as possible, please have the following ready:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiaries:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

To get the best experience with our new website and to ensure your information is safe, we recommend you update your current browser. Newer browsers offer better protection against viruses, scams and other threats. This is especially important for members using Internet Explorer. Moving forward, Internet Explorer will no longer be supported. Experts advise users to move to a more modern and safer browser like Edge, Chrome, Firefox or Safari,