Purchasing a home will be the biggest investment most people make in a lifetime. If you’re currently renting and considering homebuying, the U.S. Department of Housing and Urban Development website includes helpful resources and a series of questions and answers for first-time homebuyers. Let’s take a look at a few:

- Why should I buy, instead of rent?

Answer: A home is an investment. When you rent, you write your monthly check and that money is gone forever. But when you own your home, you can deduct the cost of your mortgage loan interest from your federal income taxes, and usually from your state taxes. These savings add up over time as your home equity grows. - Can I become a homebuyer even if I have or I’ve had bad credit, and don’t have much for a down-payment?

Answer: You may be a good candidate for one of the federal mortgage programs. Start by contacting one of the HUD-funded housing counseling agencies that can help you sort through your options. Also, contact your local government to see if there are any local homebuying programs that might work for you. - Are there special homeownership grants or programs for single parents?

Answer: There is help available. While you may not have the benefit of two incomes on which to qualify for a loan, consider getting pre-qualified, so that when you find a house you like in your price range. Contact one of the HUD-funded housing counseling agencies in your area and look into local homebuying programs that could help you. - How much money will I have to come up with to buy a home?

Answer: Depending on the cost of the house and the type of mortgage you get, you will need to come up with enough money to cover three costs: earnest money – the deposit you make on the home when you submit your offer, to prove to the seller that you are serious about wanting to buy the house; the down payment, a percentage of the cost of the home that you must pay when you go to settlement; and closing costs, the costs associated with processing the paperwork to buy a house. The more money you can put into your down payment, the lower your mortgage payments will be. - Where can I find a lender?

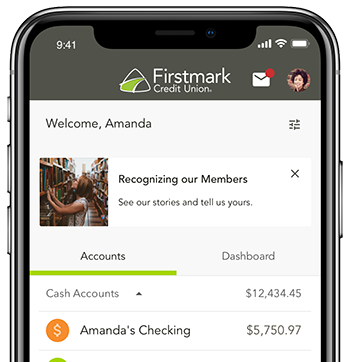

Answer: Firstmark Credit Union is here to help! We take great pride in offering members the best rates for our products. To learn about our home lending products, please visit us online at firstmarkcu.org/mortgage-loan/.