It has been challenging over the last several months to turn on the news and not hear the talking heads discuss how the COVID-19 financial shock has impacted the economy short-term and the potential long-term ramifications.

COVID-19 aside, many people experience their own personal financial shock and it is not making news headlines. Every day individuals experience unexpected expenses such as medical bills, loss of income, or an appliance breaking down. Though unreported by news stations, the effects to the individual can be equally as damaging to one’s finances. Your financial shocks aren’t “fake news”, they are personal and real.

When these unexpected expenses arise individuals are faced with difficult financial decisions. Do I raid my retirement account or take on more debt? Is a payday loan a viable option? What can I do to reduce my liabilities?

The tips below are designed to help you weather a personal financial shock.

- An Emergency Savings Account – Most individuals have a checking account to handle their monthly expenses and maybe it is paired with a savings account for more long-term expenses. Very few individuals have an additional emergency savings account. Open the additional account for unexpected expenses to avoid jeopardizing your long-term goals. Start by saving 3 to 6 months of expenses to protect yourself from a financial shock. [This new account could be your Paypal or Venmo account, or it could be a more traditional account like at your local Credit Union.]The account should be separate from your other accounts and you should have a set definition of what qualifies as an emergency. For example: An unforeseen car expense could be an emergency, but needing new tires when you know you’ve put a lot of miles on them is something you should budget for overtime.

- Payroll Deductible Loan Programs – Individuals without an emergency savings account at the time of an emergency have fewer options, but not all will break the bank. Many employers are beginning to offer financial wellness programs that allow you to take out low-interest loans that get deducted from your paycheck. These usually have lower credit requirements and can actually help increase your credit score. This kind of tool can also be used to consolidate high-interest loans to reduce the interest rate and decrease your monthly payment. If your employer doesn’t offer this option, click here to provide them with information on how they can start it at no cost to the entity.

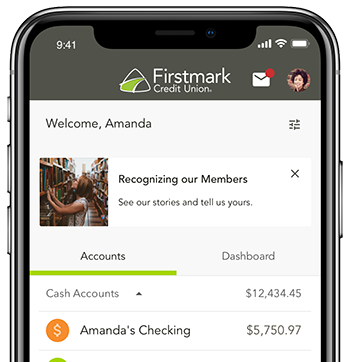

- Credit Unions – Individuals without access to payroll deducted loans can obtain a short term loan at a credit union. While not payroll deducted, credit unions typically offer lower interest rates and more favorable terms than a traditional bank. Starting a positive relationship with a financial institution is a good place to start in case you need a more traditional loan in the future. Tip: Credit Unions often cater to specific types of employees, usually public employees like educators or state, city, and county employees and their families.

Things to Avoid During a Personal Financial Shock

- Payday Lenders – Avoid utilizing a payday lender for immediate cash. Generally, the interest rates are significantly higher than you will find at a credit union or traditional bank. The term “predatory lenders” is associated with Payday Lenders as they benefit from you staying in a cycle of debt with them; especially if you are required to put up collateral such as your car or appliance. These businesses are not looking out for your best interest and can put you into a debt snowball.

- Loans Against a Retirement Account – Loans against your retirement are your last resort. While some providers have reasonable terms (low-interest rates that are paid back to yourself) many others do not. These loan options remove the money from being invested and working for you and your long term goals. It is rarely advisable to take a withdrawal from dollars designed to fund your retirement. Before jeopardizing your retirement savings, meet with an unbiased financial professional to see what other options are available to you. You work hard for your money, consult a professional to find the best solution for you.

- Do Not Stop Your Retirement Plan Contribution – To the extent it is cash flow possible, it is recommended that you do not stop your contributions to your retirement account (457b, 403b, 401k) during these times. Individuals who stop contributions for the short-term to meet other goals or get through a difficult time are likely to extend their short term period which can greatly impact their retirement savings plan. This can compound your financial challenges later on, so it is recommended that you stay true to your contributions and on track to meet your retirement goals.

These tips will help guide you though financial shock, but be proactive. The best way to help yourself during a personal financial shock is to plan when times are good. Being proactive in the management of your financial health is key to prolonged stability. There are always going to be things you can’t plan for, so the best thing you can do is be prepared for anything. Build up an emergency savings account, utilize the benefits offered by your employer, and cultivate a positive relationship with your local credit unions. Take charge of your finances to avoid an unexpected financial shock becoming a financial meltdown.