MENUMENU

- Join Us

- Our Story

-

-

-

Our story began over 90 years ago at Fox Tech High School, where ten teachers signed a charter to form San Antonio Teachers Credit Union.

-

-

- Loans

- Accounts

- Firstmark Foundation

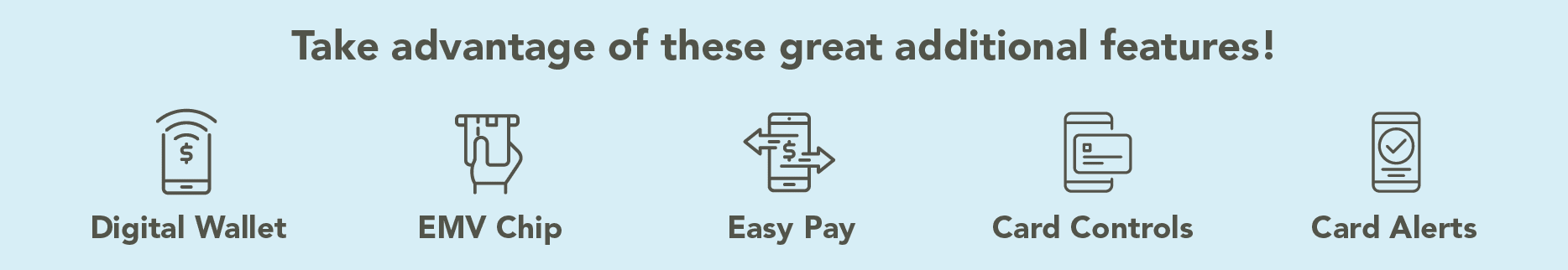

Having the right credit card just makes life easier. We offer two Firstmark ONE® VISA® Credit Cards with great rates and rewards to help you live your best life. And with Digital Wallet, you can shop with ease and convenience.

|

|

Benefits & Features

Benefits & Features

Rewards

Digital wallets give you payment solutions that are fast and easy. Pay for purchases in-store from your mobile device, tablet or smartwatch.

How It Works

Set-up your Digital Wallet today!

Existing Firstmark card holders: Contactless cards will be available upon card renewal. If you want to renew your card earlier, a contactless card will be issued upon your request.

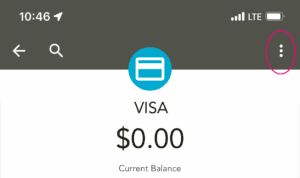

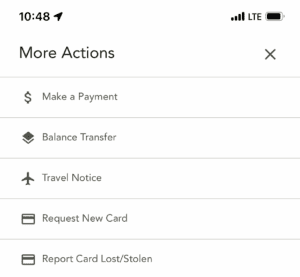

Download the Firstmark Mobile App to manage your credit cards with just a few clicks. Log in and select your Firstmark credit card to:

Step 1

Step 2

Protecting your personal and financial information is our top priority. Our courtesy credit card alerts help keep your personal information safe and may protect you from fraud.

Enroll your card to instantly begin receiving alerts notifying you when transactions are made to your account.

For members who elect to receive alerts via a text message, standard text message and data rates apply. Please check with your mobile carrier to ensure that you own an SMS capable mobile handset that is registered on a carrier network and elected for a data plan that includes use of the mobile handset’s SMS capabilities.

Log in to online banking to sign up for card alerts.

| Which Card Is Right For Me? | Firstmark ONE® Visa® Platinum | Firstmark ONE® Visa® Platinum Rewards |

|---|---|---|

| What is most important to you in selecting a card? | Lowest Rate | Low Rate With Rewards or Cash Back Option |

| How would you describe your credit card usage? | Occasional I only use it when cash is not available |

Moderate I use it when it’s convenient and on larger purchases |

| Do you carry a balance on your card? | Often I want to minimize the interest that I am charged |

Sometimes During certain times of the year |

| On average, how much do you charge on your credit card per month? | $50 – $500 | $250 – $1,000 |

Annual Percentage Rate. There is a 5.99% APR on all purchases from account opening for 180 days (or 6 months).

Introductory balance transfer rate of 0% APR for 12 months following the date of account opening. There is a 3% balance transfer fee (Finance Charge) on all balance transfer amounts that will be posted to your account within the next billing cycle. After the introductory period ends, an APR of 13.00 - 18.00% will be applied to the balance transfer balance of your account, based on your creditworthiness. New card members only. All balance transfers must originate from non-Firstmark credit card issuers within 90 days of opening date. Balance transfers are not eligible to earn rewards. Maximum total transfer amount is limited to your available credit line. To avoid interest on new purchases after you transfer a balance, you must pay all balances on your account in full by the first payment due date, including any balances you transfer under this offer. Promotion terms may change from time to time by Firstmark Credit Union.

APR is Annual Percentage Rate is accurate as of 04/23/2024, and is subject to change without notice. APR is variable and your specific APR will range between 13.00% and 18.00% on Platinum card, 15.00% and 18.00% on Platinum Rewards card and 16.50% and 18.00% on Signature card depending on your creditworthiness. Penalty APR: 18.00%. Foreign Transaction Fee: Up to 1.00% of all international transaction amounts. All usual credit criteria apply. Other restrictions may apply. Credit union membership is required to obtain a credit union loan. APR based on Wall Street Journal prime rate plus a margin.

Log into Online Banking

Need to Enroll in Online Banking

To make this process as quick as possible, please have the following ready:

Not signed up for online banking?

No problem, click here.

Log into Online Banking

Need to Enroll in Online Banking

To make this process as quick as possible, please have the following ready:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiaries:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

Needed Items

To make this process as quick as possible, please have the following ready for yourself and any joint account holders on the account, including beneficiary’s:

Choose one of the following:

To get the best experience with our new website and to ensure your information is safe, we recommend you update your current browser. Newer browsers offer better protection against viruses, scams and other threats. This is especially important for members using Internet Explorer. Moving forward, Internet Explorer will no longer be supported. Experts advise users to move to a more modern and safer browser like Edge, Chrome, Firefox or Safari,